How I Found Financial Independence at a Young Age

By Aaron Josephs

I was on what many would describe as “the path to success.” I grew up in a well-off family with parents who told me to “never worry about money” because they were able to help when I needed it. I was bright and did well in school. I got to explore various extra-curricular activities, finding ones that interested me. I went to an elite college and graduated with no student loan debt. I graduated with a Computer Science degree and got a job working for a Fortune 15 company.

Less than a year out of college, I had a beautiful one-bedroom apartment to myself, a job that put me above the median income for the country in my first earning year, I was shopping for a new car, I traveled each month, and knew I was on the typical path to success.

What was missing?

There was nothing wrong with my life. I wasn’t miserable in some horrible job, and I wasn’t racking up debt. But I also wasn’t particularly fulfilled. I had never wanted to work a corporate job for my entire career. I just thought that was what I should do for now.

I didn’t know much about money since we never talked about it in my house growing up. I knew how interest compounded and what a credit score was, but I definitely didn’t know the difference between a Roth IRA and a traditional 401k when I got the option at work. So I had two things I wanted to figure out:

- If I’m making a good income now, how can I be smart with my money?

- If I’m not fulfilled now, how do I make my life fulfilling?

Finding the answers

I started spending a lot of time researching both of these topics. I knew the things I loved. I loved learning and teaching martial arts growing up. I loved theatre and stage combat throughout high school and college. And I loved the time spent with my friends and family.

And there were luxuries I really wanted, too, whether it was a beautiful chef’s knife or to drive a Tesla. I just had been told by the whole world to consider those things “nice to haves” or things I got to reward myself with when possible, not the things to base my life around. I learned about different strategies for living the life I wanted. Some seemed more reasonable than others.

Financially, I learned about a multitude of strategies, from day-trading penny stocks to automating investments (side note: I’ve researched this a lot, if those are your choices, go with the latter).

Eventually, I discovered the Financial Independence movement. The gears clicked into place. I didn’t have to choose between being financially savvy and pursuing the things I wanted. What a false dichotomy!

Looking back (to less than a year ago, by the way), I genuinely don’t know why I thought that. It’s evident to me now. The whole point of being financially savvy is that it allows me to pursue the things I want. It doesn’t matter what those things are. It’s not stupid or frivolous to want them. And it’s being smart with my money, pursuing financial independence, and knowing which things will bring value to my life that will allow me to achieve those things and live happily.

How to reach financial independence at a young age

So, in the past year, I’ve changed a lot in an effort to reach financial independence at young age. I’m still in the same job. It’s still good, but not great. But it’s a lot more satisfying now that I know what my plan is. I have moved halfway across the country, so my relationship is no longer long-distance. (I no longer need to travel each month, which was expensive.)

My rent payments were cut by two-thirds when I moved in with roommates. I decided to keep my eight-year-old car until I actually need a new one. And even then, I will be looking at one to three-year-old Toyotas, not brand new luxury vehicles.

I’m also maxing out my 401k, saving for a down payment for a possible house hack, and investing a significant amount as well. I genuinely believe I’m not sacrificing anything. I’m not sacrificing a lovely apartment, a new car, or the ability to eat out five times a week. This is because I’m not running away from a job I hate at the expense of the luxuries I want.

Instead, I’m running towards the things I love. And I’m choosing those things—the time with friends and family, the hobbies and items that I find value in, the activities and items that truly bring me value—and running towards them as quickly as possible. I’m working on buying my freedom. What’s more of a luxury than that?

Conclusion

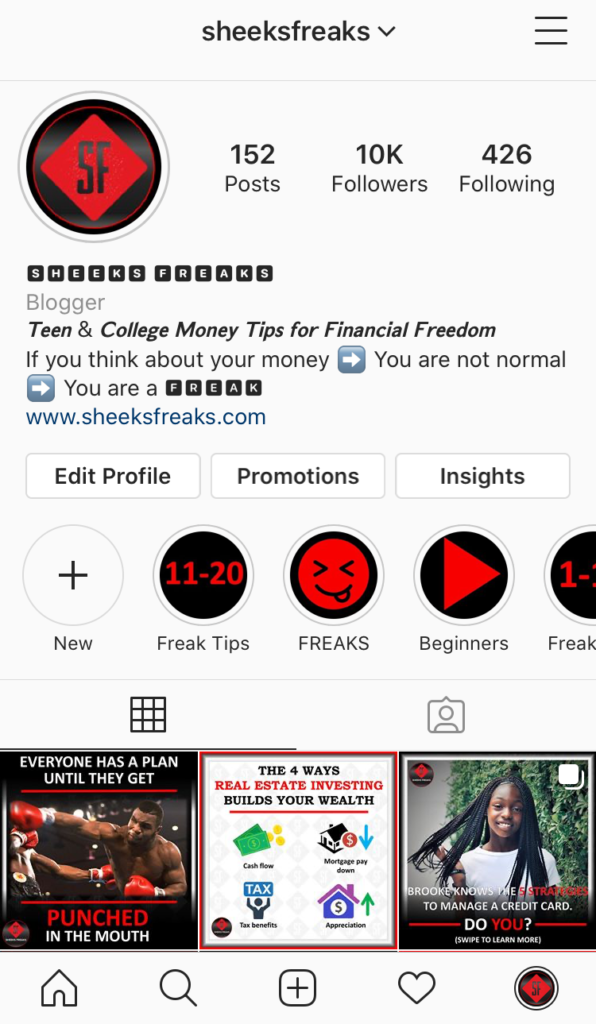

To get started on our path, join the Sheeksfreaks community on Instagram, take a look at the previous blog posts, and sign up for the email list on the website.

You can also reach me on my Instagram account if you want to chat or have questions.

I encourage you all to take a step back and look at your goals over the next five to ten years so that you can reach financial independence at a young age. Where do you want your finances to be? How much do you want to save? How many years do you want to have to work? Then take those answers and set some short term goals for yourself so that you can live your dream life, too.

And most importantly,

Leave a Reply